Because a good deal on a mortgage loan can actually save you thousands of dollars

People will go through great lengths to save coupons and track down promo codes for discounts on things they want to purchase. Yet they’ll overpay time and time again on a mortgage loan by not shopping around.

So why does this happen?

For one, the industry has purposely made it overly complicated to understand interest rate offerings. The loudest voices are the ones with the deepest advertising pockets, and with the most interest in selling you a higher priced mortgage loan.

In a close second there are those real estate agents that use their client’s trust to steer them towards certain mortgage companies. These mortgage companies don’t usually offer the best deal for the buyer, but they may share advertising costs with the real estate agent, provide them with free marketing flyers, and sponsor their various client events.

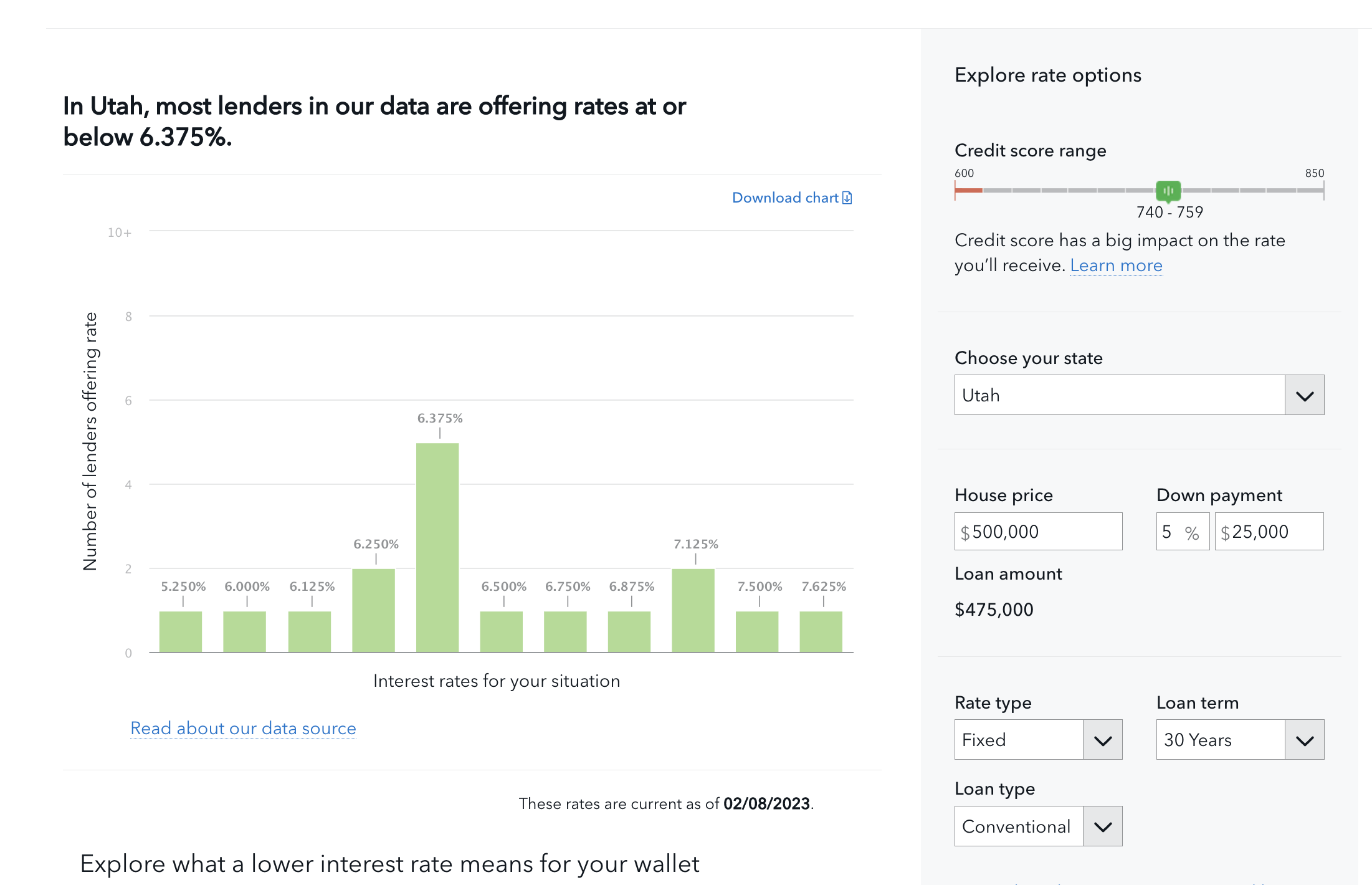

Industry regulators offer tools that can help borrowers shop around, but these tools are not very well known or advertised. The Consumer Financial Protection Bureau (CFPB) for example has a very handy link where you can explore the range of mortgage interest rates offered in the State of Utah.

So your first step is to start here and compare the interest rate you’re being offered with the average shown on the CFPB’s website. Make sure you input your loan details on the right-handed sidebar so you can see your particular scenario.

Here is an example of what the CFPB is reporting on February 13, 2023. I’m happy to provide you with an actual quote if you want to email me at [email protected]

Before you even apply for a mortgage loan

If you’re just getting started, you won’t have any of the official loan disclosures associated with mortgage applications.

Start getting some quotes in writing, as this will give you an idea of numbers, as well as help you decide who you want to work with.

I emphasize “in writing” because the common practice of predatory or overpriced lenders with purchase loans is to:

- Give mortgage Pre-Qualifications/Pre-Approvals without disclosing the rate or fees associated with it.

- If a borrower asks about their projected mortgage payment and closing costs, they’ll get a verbal number with no actual breakdown or proper disclosures. This by the way is illegal, and your biggest red flag.

Whether you’re looking to purchase or refinance, you have a right to ask for a quote or a fees worksheet without having to hand over your social security number or any other personal information.

A loan officer can run a quote based on the numbers you give them, such as your estimated credit score, the purchase price or appraisal value, loan amount, type of loan (Conventional, FHA, VA, USDA), type of property (condo, townhome, single family or multi unit) and occupancy (primary residence, second home or investment).

If a mortgage company tries to tell you otherwise it’s because they want you invested and not shopping them around. The more of your time and documentation you give them, the more invested you are.

Pay attention to how responsive a loan officer is, how easy or hard it is to get ahold of them, and how willing they are to answer your questions. It’s ok to have high expectations because you’re in the interview phase where any mortgage company should try to earn your business.

I would love to earn your business by providing you with a detailed quote based on numbers you give me, and I can usually get it to you in a matter of hours. You can text me at (801) 473-3154 or email me at [email protected]

Shopping your mortgage loan while under contract

If you’re already under contract on a home and have started a loan application, you will receive an Initial Loan Disclosure package from your lender. This also applies if you’re doing a mortgage refinance.

For our purpose, the most important piece of document you want to focus on is the Loan Estimate (LE).

The Consumer Financial Protection Bureau website has a handy page explaining what this form is, and what each section mean if you want the detailed breakdown.

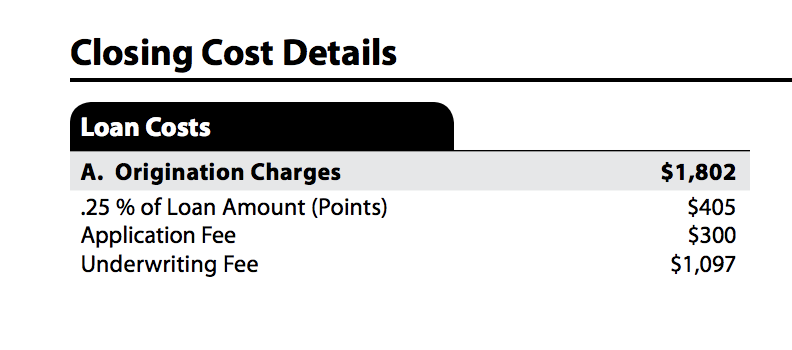

I like to break down the mortgage loan costs into 3 categories so it’s easier for my clients to understand. There are origination charges, third-party costs, and prepaid items.

Here’s the secret to using your Loan Estimate to shop lenders:

The “origination charges” section is the only cost that really makes a difference when comparing lenders.

Go to page 2 of your Loan Estimate.

At the top of page 2 in Section A. Origination Charges you may see the following fees:

- Discount points / Origination charge

- Underwriting Fee/Administration Fee

- Application Fee

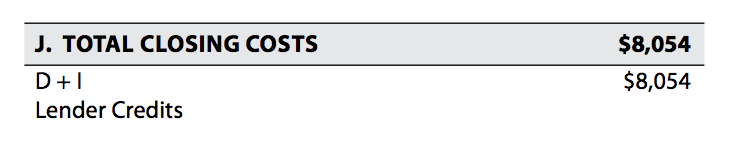

Always check line J as well – Lender Credits. A “no cost” loan will have a chunk of lender credit listed on there. That means that the lender is offsetting some or all of your closing costs in exchange for you accepting a slightly higher interest rate.

The other closing costs listed on this page 2 will all be third party charges and pre-paid items. While small differences will be present depending on the provider, this is not typically an area of concern. You’ll see fees like: appraisal, credit report, title insurance and settlement charges, deed recording charge, 1 year pre-paid homeowner’s insurance and the initial escrow setup.

Keep in mind that mortgage interest rates fluctuate daily with market conditions. When shopping multiple mortgage companies, try to get the quotes as close together as possible, and ask for the same interest rate so you can compare apples to apples.

I’m always happy to give out quotes and earn your business. Please email me the details of your loan scenario at [email protected]. I don’t require a credit pull if you know your credit score, and I can work based off a competitor’s Loan Estimate, or with numbers you provide me.

If your loan officer has pulled credit, you have a right to know your credit score, so just ask them, or look for the credit score disclosure in your initial disclosures package. Otherwise you can create a free login with Experian and their credit score is usually pretty accurate.

Savvy mortgage shopper final tips

I know it can be intimidating if you’re a first time homebuyer, or if you’re someone trusting that hasn’t asked a lot of questions in the past.

The easiest way to protect yourself is to understand which questions you need to ask, and know that it’s ok to ask them. Don’t let anyone dismiss you just because you’re not in the industry. A home is a big financial investment – protect it.

Here are a few more nuggets that will turn you into a savvy mortgage shopper, whether you feel like one or not.

You can choose your interest rate

When you’re shopping around for a mortgage loan, a good loan officer will give you a few different rate options to pick from. Each interest rate should list the costs or credits associated with the rate, and show the impact on your cash to close.

Ask for quotes on the same interest rate from multiple mortgage companies so you can compare apples to apples. If you haven’t been offered multiple options, then ask for them.

If you ask and don’t receive, keep shopping.

There is NO SUCH THING as a no-cost loan

I can’t stress this enough, given how many borrowers are being misled by the no-cost sales pitch.

“No cost” just means that you are being given a higher interest rate, in exchange for the lender paying for part of/all of your closing costs.

It can be a mutually beneficial situation if you’re tight on cash, but make sure you’re being explained all the options. Mortgage companies that go out of their way to convince you they’re doing you a favor by offering a no cost loan are probably overcharging.

APR can be confusing

The APR was designed to help borrowers choose the loan with lower costs. Because of loopholes, some lenders have to disclose all costs, while others can hide some of theirs.

Make sure you compare the APR for the exact same interest rate and loan terms. Also compare the cash to close and your actual loan amount, since costs can be rolled into it on a refinance.

Bigger doesn’t mean better

You see the billboards on I-15, you hear the adds on the radio. But that kind of advertising doesn’t come cheap.

What you are likely to get by working with a big mortgage name is a higher interest rate, a more expensive loan, and a lower quality of service.

Additional tips: Under NO CIRCUMSTANCE should you ever pay an up-front mortgage application fee. And if you’re tempted by that “cash back” offer from your online bank, get at least one second opinion to see how much that cash back is really costing you.

Who you work with matters

There are mortgage loan officers out there that will do whatever it takes to get your business. They also disappear shortly after you submit the application. Watch out for these red flags:

- Refuses to give you a mortgage quote without pulling credit first

- Promises to match or beat any other lender, but tries to overcharge you to start with; then guilts you into staying because of the amount of work they put into your file

- Is hard or impossible to reach after your application is submitted

- His/Her name doesn’t show up as the loan originator on your file.

Trust your instinct. Ask questions. Push for answers in writing. Hold that person accountable for what they tell you, and if things change, ask why.

A long time ago I wrote a blog post called 5 Signs You Should Ditch Your Mortgage Loan Officer! It was based on actual borrower complaints, and unfortunately these sort of things still happen. Hopefully they won’t happen to you, because after reading all of this, you’ll know what to expect when getting a mortgage loan.