Utah USDA Rural Loan

USDA stands for United States Department of Agriculture. The Rural Housing Service (RHS) is a department within USDA that offers the Guaranteed Rural Housing Loan Program – most people know it as the USDA Loan.

The USDA loan program is designed to assist low and moderate income families in getting affordable mortgages in eligible rural areas. To access the USDA loan eligibility map, click here.

While I only originate mortgage loans in Utah, these USDA loan program guidelines will apply in all states, with the expected variations in income limits.

There are a number of restrictions associated with USDA Rural loans, but don’t let that deter you from purchasing an eligible property. If you don’t mind living further from the busy city life, USDA loans rank number two in my book – right after the VA military loans. What’s there not to like?

- 100% financing, no down payment required

- closing costs can generally be covered with a slightly higher interest rate, or via seller concessions

- lower interest rates specific to government loans

- no mortgage insurance, just a very low annual fee

- more house for your dollar, due to the rural location requirement (and more time spent NOT IN TRAFFIC!)

Please note that while USDA technically allows construction loans, lenders will not do a construction loan with less than a 20% down payment.

You can try to find a builder that will carry the construction loan for you, and allow you to do the permanent financing as a USDA loan once the home is completed (the process is started about 30 days before the estimated completion).

Odds are, a builder will be unlikely to take the risk of building a custom home for a client with “no skin in the game”, and no ability to cover a low appraisal.

Custom construction also takes month, time in which you your circumstances could change, making you ineligible for the loan.

————————————————————————–

Just like Utah FHA loans have an Up Front Mortgage Insurance fee, and an Annual Mortgage Insurance fee, the Utah USDA loan has a Guarantee Fee, and an Annual Guarantee Fee.

The Guarantee Fee amount is currently at 1%

The Annual Guarantee Fee amount is currently at 0.35%

Example: On a $200,000 loan amount with 100% financing, your upfront/one-time Guarantee Fee would be $2,000; your annual guarantee fee would be $700 – which translates into $58.33/month.

Not all real estate agents know the details on the USDA loan program. If you’re in Utah, but don’t yet have a real estate agent, ask me for a recommendation. I make sure the ones I work with are well educated on this program.

USDA Home Loan Options In Utah

The only loan option available at this time is a 30 year fixed interest rate loan only.

USDA Loan Property Eligibility

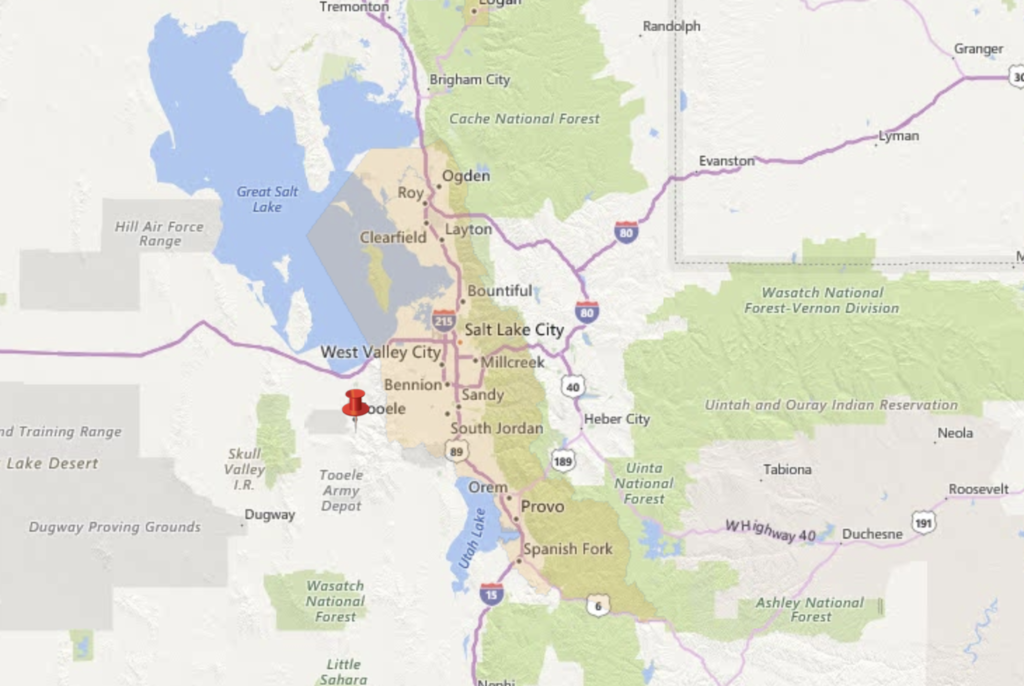

Finding the eligibility of a property is easy when using the official link to the USDA map. Just to give you an idea, here is how the map looks in Utah:

USDA Home Loan Property Requirements

- Must be a single-family residence, an approved condominium (by Fannie Mae, Freddie Mac, HUD or VA) or a PUD (Planned Unit Development) – a townhome;

- The property must be non-farm, non-income providing

- Maximum acreage is 40 acres

- The value of the site should not exceed 30% of the total value of the property (exceptions may apply if excessive land value is customary as evidenced by the appraisal)

- The property must be in “marketable” condition at the time of closing, meaning it can be sold in its current condition if necessary.

Because this is a loan program designed to help low to moderate income families, you cannot own any other homes at the time of the USDA loan closing. If you do own other property, it has to be sold prior to, or concurrently with your USDA loan closing.

An exception can be granted if you are relocating, and your other home is either:

- not in the same commuting area (at least 50 miles distance)

- functionally inadequate (USDA regards a mobile home not on a permanent foundation as functionally inadequate

USDA Home Loan Limits In Utah

USDA Home Loan Income Limits In Utah

We’ll look at the USDA income restrictions in two areas that can impact your approval: actual income, and assets owned.

Income Limits

Your household income may not exceed 115% of the area’s median income level as determined by rural development. You can check your eligibility on USDA’s website by clicking here. There is also this pdf that will faster.

Keep in mind that adult household members (over 18 years of age) that are not on the loan application must also provide income verification for their employment status.

Adjustments to reduce annual income include:

- $480 for each minor child, full-time student, or disabled family member

- $480 for each disabled or handicapped individual who is not the applicant or co-applicant

- $400 can be deducted for each family member over the age of 62

- $480 for each full-time student

- Anything that exceeds 3% of gross annual income in medical expenses for any elderly family member;

- The actual cost of care for child care expenses – if the children are 12 years old or under.

Borrower Assets

You must not have sufficient assets to meet the downpayment and closing costs associated with a Conventional, uninsured mortgage product (that means you will not qualify for a USDA loan if you have the financial assets to make a 20% down payment based on the purchase price)

Interest income for family assets over $5,000 must be considered in the household annual income.

Net family assets are defined as the value of equity in real property, savings, IRAs, demand deposits, the market value of stocks, bonds or other forms of capital investments; business or household assets disposed of for less than fair market value for 2 years preceding the date of the loan application. 401Ks are not considered in net family assets.

USDA Home Loan Credit Requirements In Utah

A 580 minimum credit score is required for approval, though many lenders have moved towards asking for 620.

At least one applicant whose income or assets are used for qualification must have at least 2 historical credit accounts (auto loan, credit card, personal loan etc) with at least a 12-month history. These accounts can be open or closed.

In the case of people that have been through a past bankruptcy, they will need to re-establish credit before applying for a mortgage loan. This means current accounts in good standing are required.

Your credit history must indicate a reasonable ability and willingness to meet obligations as they become due.

If your credit is between 580-639, your rental or mortgage history in the past 12 months will be analyzed, and any late payments will have to be explained. There is additional scrutiny, and a final USDA underwriting approval is required for credit scores under 640, which can add 1-2 weeks to your loan closing time frame – depending on how busy the local USDA office is.

Derogatory Credit

Bankruptcy

Chapter 7 must be discharged at least 3 years back with an acceptable credit history since the bankruptcy. A 2-year waiting period is acceptable if extenuating circumstances can be documented.

Chapter 13 borrowers are eligible if they have 12 months of on-time payments on the repayment plan, and approval from the bankruptcy court/trustee.

Foreclosure

Has a 3 year waiting period from the date the title was transferred out of your name (which is not always the same as the foreclosure date – check the county records, or with your previous lender)

Pre-Foreclosure And Short Sale

3-year waiting period. The credit report must reflect a zero balance on any mortgage liens included in the foreclosure /short sale OR documentation must be obtained to support no further obligation.

Exceptions may be considered to the 3-year wait, if the credit profile demonstrates strong mitigating circumstances, such as:

– 640 or greater credit score

– Satisfactory 12-month documented housing payment history

– NO late payments leading up to the short sale, and the circumstances leading up to short sale must have been beyond the borrower’s control and temporary in nature.

Delinquent Student Loans

Must be satisfied prior to loan closing, or have an acceptable repayment plan, reporting six months of positive payments.

Late Payments

On any installment accounts within the past 12 months – only one is acceptable. A letter of explanation will be required.

Qualifying Debt To Income Ratios

Standard qualifying ratios of 29/41 may be exceeded with compensating factors.

- 29 represents the percentage of your gross income that should be taken by the new house payment.

- 41 represents the percentage of your gross income that should be taken by the new house payment, along with your other monthly obligations reported on your credit report (such as car payments, credit card payments, personal loans etc)

Compensating factors can be:

- a credit score over 680

- the new proposed house payment is equal or less than the verified current house/rent payment

- savings, cash reserves or liquid assets are equal to, or grater than 3 months of the mortgage payment (taxes and insurance included)

- at least 2 years of stable employment history with current employer.

Co-Signed Loans

Can be excluded from the debt ratios if it can be verified that the main borrower on the loan is current on the loan payments over the past 12 months (bank statements or canceled checks are required).

I hope this article answers most of your USDA rural home loan questions.

If there is anything else you’d like to know about, please e-mail me at [email protected] or call/text me at (801) 473-3154.

Use my easy, secure online application and I will prepare a USDA Pre-Qualification Letter within hours, letting you know the loan amount you can qualify for.