Considering a Utah Jumbo Mortgage Loan?

If you are looking at more expensive properties in Utah, you’ve probably heard the term jumbo loan.

For any home loan that exceeds the conforming limit of $453,100 throughout most of the U.S., approvals will be subject to different, tougher requirements.

For Utah specific 2018 conforming limits, please read my article on the Utah Conventional Mortgage

What to expect when applying for a Utah Jumbo loan

- You will be required to make a larger downpayment, typically of at least 20-25% of the loan amount;

- Your reserves/emergency funds should cover your mortgage payment for a minimum of 6 to 12 months

- You’ll need a credit score of at least 720 (680 might be acceptable in the right circumstances)

- Your debt to income cannot exceed 43%, in some cases 40%

- Expect a higher interest rate and possibly a request for a second appraisal to be performed.

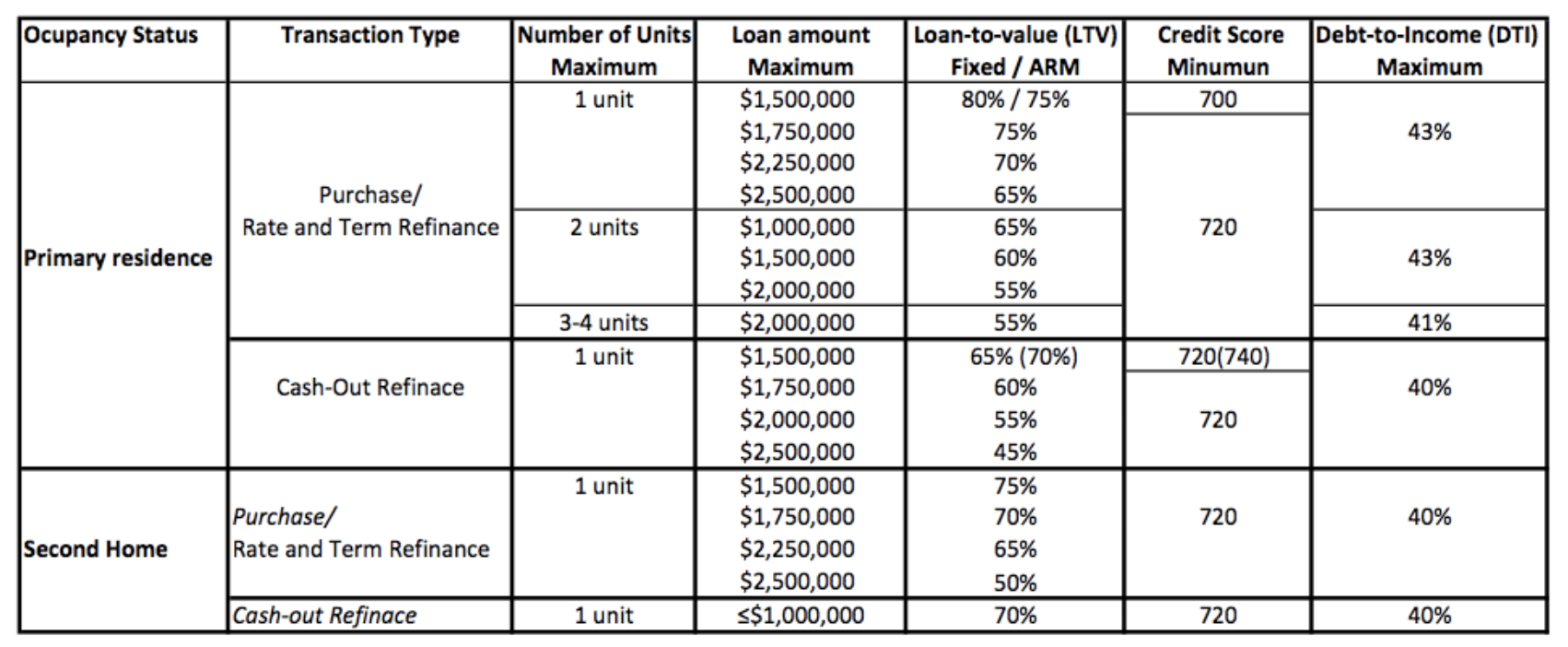

After comparing a few different lenders that offer Utah Jumbo loans, I came up with an eligibility matrix that will explain the basics. Note that investment properties are ineligible under current jumbo loan guidelines.

Utah Jumbo Loan Eligibility Matrix

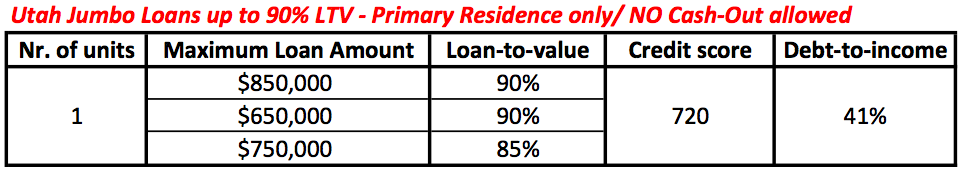

For Utah Jumbo loan amounts up to $850,000, it is worth mentioning the following alternative:

While most jumbo loans require a minimum downpayment of 20%, some mortgage insurance companies like Radian will insure part of a jumbo loan, and help lenders provide financing. In this situation, the borrower only needs to come up with 10% downpayment.

The 90% loan to value eligibility matrix looks like this:

Utah Jumbo Loan requirements

Utah Jumbo mortgage loans follow Conventional guidelines for the most part, with a few noticeable differences.

- Non Occupant Co-Borrowers and Non-Arms Length transactions are not allowed;

- Borrowers with past loan modifications are ineligible

- There is at least a 5 year waiting period after bankruptcy/ short sale/ deed-in-lieu and 7 year wait after a foreclosure;

- All accounts on the credit report must be current and present – no +60day late payments in the past 2 years

- Gift funds are not permitted – that includes the gift of equity; the cash to close must come strictly from the borrowers own funds;

- Interested Party Contributions, such as seller paid closing costs are limited to 6% of the loan amount.

There are other ways to help you purchase or refinance a higher priced home in Utah without applying for a jumbo loan.

The most obvious solution is to provide a higher downpayment, making sure that the requested loan amount fits the conforming Utah County limits.

If that’s not possible, then you will want to find a lender that will allow a first and a second mortgage. The first mortgage can be a conforming loan, and the second can be a HELOC (Home Equity Line of Credit) or an Equity Loan (fixed second mortgage). Not easy, but that’s what mortgage brokers are for.

Your questions are welcomed either by e-mail at [email protected] or by phone at (801) 473-3154 (call/text).